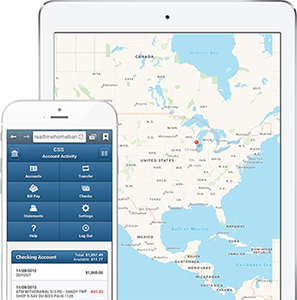

Real Time

Home Banking

Bank on your time with Real Time Home Banking. Desktop access combined with iOS and Android apps allows you to securely and conveniently keep track of all of your finances.

Login to Home Banking

Security

Multiple levels of security to ensure your money is safe!

Mobile App

Manage your finances on the go!

Transfer Funds Instantly

Transfer funds to other credit union accounts or loans!

Accounts

Accounts

KHFCU offers a variety of accounts to meet your needs. You have 24-hour access to your money with the use of our VISA debit card, which can be used anywhere VISA is accepted and at any ATM. Find surcharge free ATM locations using our ATM locator.

View Fee Schedule

Regular Share (Savings) Account

The Regular Share Account establishes your membership and makes you a part owner of Kaleida Health Federal Credit Union. Eligible persons can open a share/savings account at the credit union with a minimum deposit of $6.

Holiday Club Account

Holiday Club Accounts are an easy, painless way to save for your holiday expenses. Put aside any amount you choose; at any time, or have the money deducted directly from your payroll check.

Funds automatically transferred into Share Account each year in October. Dividends are paid quarterly on average daily balances of $100 or more.

Vacation Club Account

Are you planning that dream vacation? There’s no better way to save up and make that dream come true than opening a Vacation Club Account with the KHFCU. Put aside any amount you choose; at any time, or have the money deducted directly from your payroll check. One free withdrawal per quarter. Dividends are paid quarterly on average daily balances of $100 or more.

Term Share Deposits

- Available in 12- and 24-month terms.

- Minimum $500.

- Dividends are paid quarterly.

- The dividend rate is fixed for the term of the Term Share Deposit.

- Withdrawals prior to maturity are subject to a penalty.

Share Draft Checking Accounts

- $50 opening deposit

- Direct Deposit

- Low monthly fees with ways you can avoided them all together. Ask for details at your account opening or by calling.

- Online Banking e-Statements

- Visa® Debit Card/ATM Card – Direct deposit is required for approval

- Our members can visit more than 5,400 CO-OP Shared Branch Locations and hundreds of CO-OP ATMs.

- See fee schedule

Debit Card

In order to manage risk, Kaleida Health Federal Credit Union does require a minimum direct deposit of $50 from all individuals who wish to open a checking account with a debit card. Based on the new Account Guidelines, an individual may or may not be able to join the credit union and/or open a share draft account, and/or receive a Debit or ATM Card.

For more information, please see your credit union representative.

Important Information About Procedures for Opening a New Account

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth and other information that will allow us to identify you. We will also ask to see your valid driver’s license or other identifying documents.

Who can join KHFCU

Employees of Kaleida Health, Brylin Hospital along with persons who work regularly in the Health Care Industry in the New York counties of Erie or Niagara, and their family members, are eligible to join KHFCU.

How to join KHFCU

To become a member of KHFCU, please come in person to one of our locations, with valid government issued photo ID (non-expired drivers license, identification card, passport) work ID, along with $6.00, cash or check, for a Savings account. Also, please bring proof of current address if it is not printed on your photo ID (utility bill, insurance, cell phone bill).

Services

KHFCU is all about helping you -- the member -- to save while providing affordable services, loans and credit at fair rates of interest. We are known for our personalized attention to our members' financial needs and we offer a number of convenient services to accommodate those needs.

Apply for a loan!

- Free direct deposit into checking or savings account

- Payroll deduction -- deposit a portion or your entire pay into your accounts

- Line of Credit Overdraft Protection against insufficient funds without any fees!

- ATM access

- Home Banking

- E-Statements

- Wire Transfers

- VISA Debit Cards

- ACH deposits and withdrawals

- Loan Protection

- Cash withdrawals

- Statements of all activity of your accounts

- Shared Banking

- Skip-A-Pay

Loans

Whether you want to buy a new car, make home improvements, or consolidate debt, KHFCU can help with a choice of loans offering favorable rates for members.

Home Equity Line of Credit

The possibilities really are endless

What's your next big expense? Maybe home repairs, college costs or debt payments. A Home Equity Line of Credit (HELOC), gives you the flexibility you need.

- Your home must be in New York State and owner-occupied

- Borrow from $10,000 to $100,000 (up to 80% of home's equity)

- Borrow as many times as you wish over a 7-year draw period and 15 -year term.

- No annual fee or early termination fee’s

- Closing cost paid out of the loan proceeds

- Access your credit whenever you need it with some of the lowest borrowing rates currently available.

*APR=Annual Percentage Rate. Rate and eligible LTV may vary based on individual credit history and underwriting factors. Rates are variable and based on the prime rate published in the Wall Street Journal plus margin. Property insurance required. Consult your tax advisor for details on the tax deductibility of interest. Interest rates and program terms are subject to change without notice. Must be a Kaleida Health FCU member to qualify.

Home Loan ApplicationAuto, Recreational, and Boat Loans

Searching for just the right vehicle, RV or Boat can be extremely time-consuming. Don’t waste additional time searching for a place to finance your loan.

Our rates are competitive, the loan application process is quick and convenient, and the service you’ll receive is friendly and efficient. We finance both new and used cars, trucks, motorcycles, RVs, boats and ATVs.

Auto, Recreational, and Boat Loan ApplicationPersonal Unsecured Loan

A Personal Unsecured Loan is a quick and easy way to help you meet the needs that are important to you and your family. Personal Loans are simple, convenient, and flexible, giving you control over your finances. You can even use this loan to consolidate high interest rate credit cards.

Personal Unsecured Loan ApplicationHome Mortgages

Kaleida Health Federal Credit Union has partnered with OwnersChoice Funding to bring you First Mortgages. You can learn more about this service by calling OwnersChoice Funding at 1-800-342-4998.

Owners Choice FundingSallie Mae Smart Option Student Loan®

Now you can pay for college the smart way!

Sallie Mae Smart Option Student Loan®Skip-A-Pay

Plan ahead and enjoy a little extra cash when you need it.

To help stretch your budget, KHFCU offers qualified members the option to skip an installment loan payment on eligible loans. *

Simply call (716)859-5960 or stop into the Credit Union to get started. A loan officer will be able to tell you if your loan qualifies and prepare the agreement for you to sign. For each approved Skip-a-Pay there is a $25 fee to cover processing for each payment you're skipping. The processing fee can be paid by check, cash or by withdrawing from your Kaleida Health FCU account.

Forms and payments must be received THREE or more business days prior to the due date of the month you're planning to skip. Interest will continue to accrue on your loan(s), and your final payment(s) will be due one month later than usual.

PICK YOUR SKIP

Qualified accounts may utilize up to two skips per eligible loan each calendar year - choose any month!

*Home equity line of credits & real estate loans, share secured and line of credits, do NOT qualify for this offer.

ATMs & Shared Branch Banking

Make yourself at home at credit unions nationwide.

Our members can visit more than 5,400 CO-OP Shared Branch Locations and hundreds of CO-OP Shared Branch express self-service terminals.

From coast to coast, you're welcome at branches and ATMs wherever you see the CO-OP logos. That covers a lot of territory - whether you're across town, or traveling far from home for business or pleasure. Your credit union membership means you can:

- Use nearly 30,000 surcharge-free ATM locations - more than some of the biggest banks offer

- Take advantage of surcharge-free ATMs at convenient places like 7-Eleven®, Costco® and Walgreens

- Visit over 5,000 convenient branch locations and more than 2,000 self-service locations covering all 50 states - simply have your credit union name, account number, and a government ID and you'll have access to your accounts

- Easily locate ATMs and branches through any of our locator tools - including phone, mobile app or Internet

Click the button below to find a shared branch or surcharge-free ATM right now!

ATM & Shared Branch Locator